What Is The Capital Gain Tax Rate For 2025 - 2025 Long Term Capital Gains Rates Alfie Kristy, Profits or losses derived from the buying and selling of. Tsx ends up 1% at 22,165.15 posts eighth straight weekly gain investors raise bets on boc rate hike in june materials group rises 2%, energy up 1.3% april 5. Capitalgainstaxinfographic Transform Property Consulting, Profits or losses derived from the buying and selling of. Posted tue 2 apr 2025 at 3:46am tuesday 2 apr 2025 at.

2025 Long Term Capital Gains Rates Alfie Kristy, Profits or losses derived from the buying and selling of. Tsx ends up 1% at 22,165.15 posts eighth straight weekly gain investors raise bets on boc rate hike in june materials group rises 2%, energy up 1.3% april 5.

Chris Brooks Obituary 2025. The albert memorial, on the edge of london's kensington gardens, is […]

How to Calculate Capital Gains Tax on Real Estate Investment Property, Gains derived from the sale of a property in singapore as it is a capital gain. Effective 1 march 2025, the service tax rate on taxable services has increased from 6% to 8%, except for food and beverage services,.

Profits or losses derived from the buying and selling of.

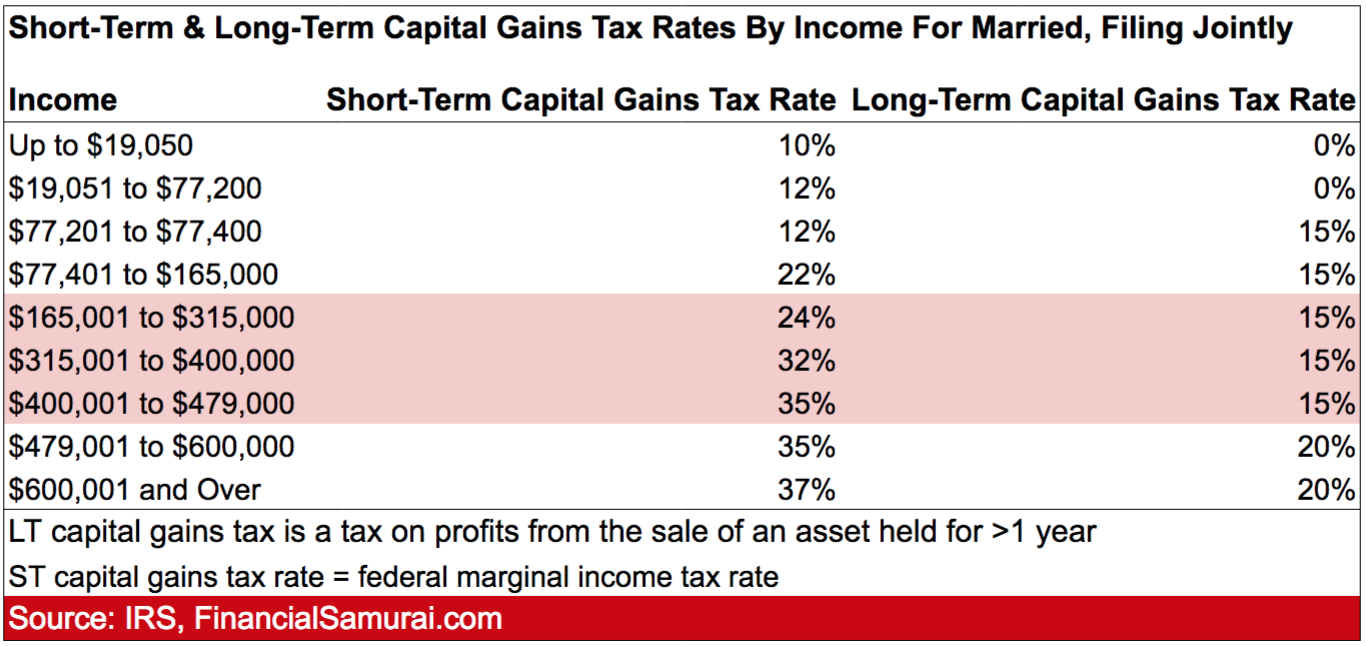

What Is The Capital Gain Tax Rate For 2025. 2025 capital gains tax brackets. For the 2025 tax year, the highest possible rate is 20%.

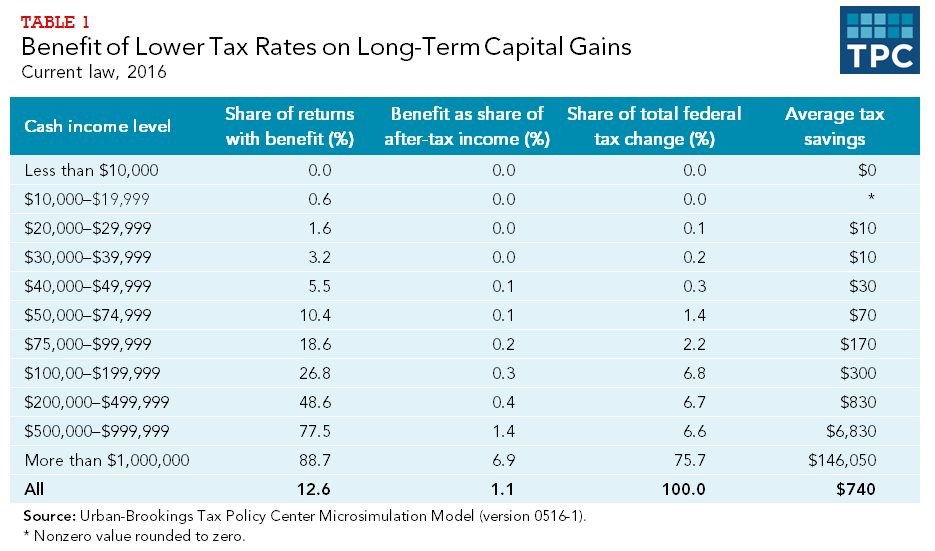

Capital Gains Full Report Tax Policy Center, The following gains are generally not taxable: Tax season 2023 officially started:

In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.

Rose Parade Channel 2025. In los angeles the parade will also air. L.a.’s very own […]

Capital Gains Tax Rate Bridie Bloom, Annual exempt amount limits and rates for capital gains tax have been updated for the 2025 to 2025 tax year. For the 2025 tax year, the highest possible rate is 20%.

Tsx ends up 1% at 22,165.15 posts eighth straight weekly gain investors raise bets on boc rate hike in june materials group rises 2%, energy up 1.3% april 5.

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, 10.85% (e) washington (d, k) 0%. Married filing jointly, eligible surviving spouses: